|

Order Manager

|

|

|

|

|

|

The Order Manager automatically places a stop and/or target order when an entry

order is filled. In addition user has also the option of moving the stop price

to breakeven or a defined level when a certain profit target has been reached. While submitting the entry order the user has to select the

pre-defined Order Manager definition from the Bracket Order drop down items.

Please do refer to the section How to create a new Order Manager below to know

how to create an Order Manager. |

|

|

|

|

|

How to create a new Order Manager

|

|

|

|

|

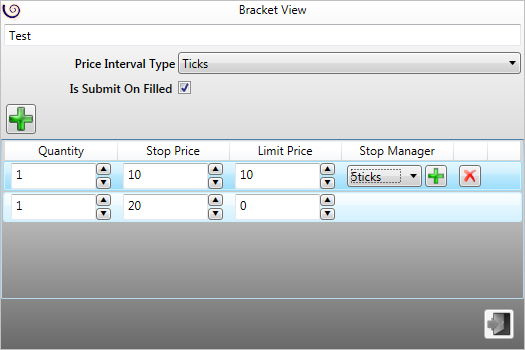

To create a new Order Manager, click on the Add button. This will open up the

Bracket Orders view. Please follow the below steps to define a new Order

Manager. |

|

|

- Append a name in the text box for the Order Manager template.

- Set the Price Interval Type.

Price Interval Type can be in Ticks, Points or Percentage.

- Ticks - Stop or target order is filled at X ticks away from the entry fill price, where X is the

defined value. Say, if the instrument tick size is 0.05 paisa and you want to

place a stop price Rs1 from the entry order fill price then just define the tick

size as 20 (Rs 1 / 0.05 paisa)

- Point - Point is the absolute value. Say you want a Rs5 stop, Then just append 5

as the stop value. If the buy entry fill price is Rs. 400, then the stop will be

placed at Rs.395

- Percentage - The stop or target price is calculated based on the % of the

average entry order price. Say the entry fill price is Rs100 and you want a 1.5%

stop, the just append 1.5 as the stop value.

- Submit on filled - If checked, then the Stop/Target order will be filled only

when entry order is completely filled.

- Click on the Add button to add a new bracket definition.

Say you have defined 2 (two) levels.

- The quantity, stop and target for the first level

is 1 (one), 10 (ten) and 10 (ten) respectively.

- The quantity, stop and target

for the second level are 1 (one), 20 (twenty) and 0 (zero) respectively.

- Assuming you

submit an order to buy 100 shares of stock X (having tick size of, say 0.05)

which gets filled at, say Rs100.00. In such scenario the following stop(s) and

target(s) order will be placed.

- Stop order at Rs. 99.5 for 50 shares as defined in level 1

- Target order at Rs 100.50 for 50 shares as defined in level 1

- Stop order at Rs 99 for 50 shares as defined in level 2

Since the target for the level 2 is set at 0 (zero) no target order will be placed.

|

|

|

|

|

|

Stop Manager

|

|

|

|

|

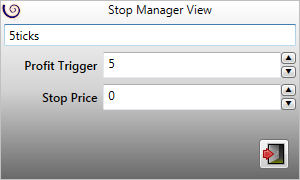

The stop manager lets user to move the stop order as submitted via the Order

Manager to breakeven or a pre-defined price (as set via the stop manager). The

Stop Manager can be invoked by selecting the appropriate stop manager item from

the combo box as found in the Order Manager levels. Below are the settings for

the Stop Manager. |

- Append a name in the text box for the Stop Manager template

- Profit Trigger - A price level where the you want to stop price to change

- Stop Price - Where the new stop price will be.

For example, you are long @ Rs. 100 (Rupees one hundred only) and want have

placed a stop price at Rs. 99.50 (Rupees ninety nine and paisa fifty only). If

you want to change the stop price at breakeven (i.e. at Rs. 100 (Rupees one

hundred only)) when market price touches Rs. 100.25 (Rupees one hundred and

paisa twenty five only), and assuming Price interval type is set at Ticks in the

Order Manager, then the Stop Manager settings will be:

- Profit Trigger: 5 (five)

- Stop Price: 0 (zero)

Note: The Stop Manager will inherit the same Price Interval Type as defined in

the Order Manager. |

|

|

|