OCO Order (Bolt+ On Web) |

The Bolt+ On Web Connection supports OCO orders (aka Bracket Orders) and are special orders which contains both the stop and target price in one order. ArthaChitra however splits the order into two orders, a limit and a stop order respectively. User needs to place a limit or stop order and the 'Other' order will be placed based on the values as defined in the order template. We will discuss in details on how to build a BOW OCO template further in the below section.

- This order template is applicable for the Boltplus On Web Connection only.

- OCO orders are supported in Exchange.BSE only

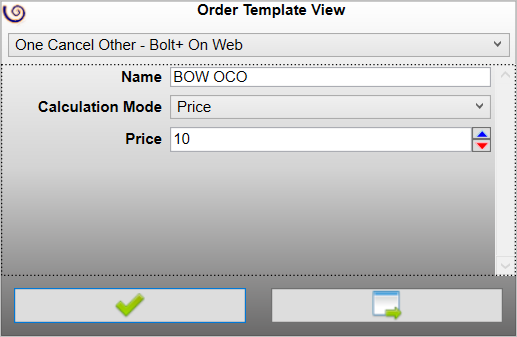

Please follow the below steps to define a new BOW OCO Order.

- Click on the Add button of the Order Template

- In the Order Template View select 'One Cancels Other - Bolt+ On Web' from the drop down items

- Append a suitable name in the Name textBox

- Select the Calculation Mode

- Apped a suitable value. Note the stop or target price will be calculated as per the selected Calculation Mode

- Click on the Ok button

Now place a stop market order or a limit order at your desired price. The other order (stop order if you place a limit order or a limit order if you place a stop market order) will be placed at a price as defined in the order template. Below are few scenarios which defines how the value is calculated:

Calculation Mode | Value | Remarks |

|---|---|---|

Price | 10 | The value is in absolute term. If you place a buy limit order say at 100, then a buy stop market order will be placed at 110. If you place a sell stop order at 90 then a sell limit order will be placed at 100. |

Tick | 100 | The value is calculated in terms of ticks where 100 denotes 100 ticks. As such if the tick size of the instrument is 0.05 then the value will be 0.05 * 100 (tick size * value) = 5. If you place a buy limit order say at 100, then a buy stop market order will be placed at 105. If you place a sell stop order at 95 then a sell limit order will be placed at 100. |

Percentage | 2 | The value is calculated in terms of percentage where 2 denotes 2%. If you place a buy limit order say at 100, then a buy stop market order will be placed at 102. If you place a sell stop order at 90 then a sell limit order will be placed at 91.8. |

Note - While placing an order:

- User must set the Product Type as OCO while submitting an order.

- User must select a BOW OCO template

- User must place a limit order or a stop market order.